If you have children under the age of 18, by now you likely have gotten your first advance child tax credit payment, either by check or by direct deposit. Be aware, this is money you would have gotten credit for on your 2021 tax return when you file it next year anyway. You are just receiving it in advance, meaning you may not get as much as expected when you file your tax return.

The Government is touting the advance child tax credit as a major step toward reducing child poverty and sustaining families during the pandemic. However, paying it in advance and in small monthly amounts may spell trouble for those who traditionally rely on large tax refunds to fund their IRAs, property taxes, vacation, etc., since their 2021 refunds may not be what they’d planned on. Others, who deliberately cut back on tax withholding during the year and use the tax credit to make up for the under-withholding when they file their return, may be surprised next spring to find they owe tax and may even have an underpayment penalty. The list goes on of taxpayers for whom the advance credit payments aren’t going to be very helpful. Small monthly payments can easily be used up on frivolous items and result in unpleasant surprises at tax time.

The American Rescue Plan Act of 2021 authorized the advance payments for one year only (2021), and the monthly payments are being made automatically to all qualifying individuals unless they go to the IRS website and opt out. The Biden Administration estimates that 39 million families are qualified for the advance payment and about 2.6% had opted out of the first payment (July 15, 2021).

The payments are estimated based on a taxpayer’s family makeup (children and filing status) and taxpayer income, since the credit phases out for higher income taxpayers. The IRS is basing the advance credits on the income taxpayers reported on their 2020 returns (or 2019 if the 2020 return hasn’t yet been filed). Some taxpayers may be in for an unpleasant surprise when they discover they were not qualified for the advance payments they received either because the number of their qualified children changed, or the children’s ages disqualify them for the credit. On top of that, many may not have been working in 2019 or 2020 and the income the advance credit was based on was lower than their actual 2021 income, which may be above the 2021 credit phaseout threshold, thereby reducing or eliminating the credit.

The credit is reduced by $50 for each $1,000 (or fraction thereof) by which the taxpayer’s modified adjusted gross income exceeds the thresholds illustrated below.

A taxpayer whose advance credit payments exceed what their actual credit turns out to be will need to repay the excess with their 2021 tax return.

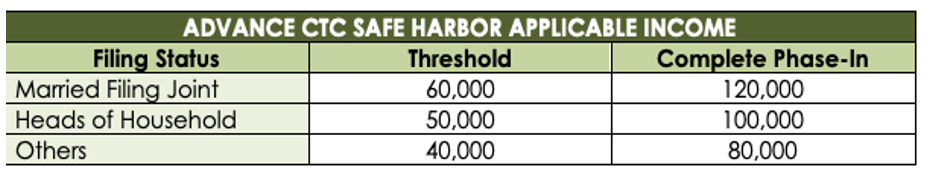

But, there is a safe harbor repayment for lower-income taxpayers where the excess advance repayment is eliminated or reduced. Thus, families with a 2021 MAGI (modified adjusted gross income) below the applicable income threshold (see table below) will not have to repay any advance credit even if they receive too much. Those with a MAGI above the “complete phase-in” amount will have to repay the entire amount of any overpaid advance credit when they file their 2021 tax return. Those whose AGI is between the threshold and the complete phase-in amount will have to repay a proportional amount of the overpayment.

Here are the credit amounts for 2021 based upon the child’s age on the last day of the year.

The advance credit is 50% of the annual credit divided into 6 payments between July and December 2021. But remember the advance credit is estimated based upon the 2020 tax return or the 2019 return if the 2020 has not been filed yet.

Example: On their 2020 tax return Harry and Mary claimed two children, one age 2 and the other age 7, and their income was under the $150,000 threshold. Thus, for 2021 they would have a child age 3 and another age 8, and the IRS would estimate their credit for 2021 to be $6,600 ($3,600 + $3,000). Their advance monthly payments would be $550 ($6,600 x 50%) divided by 6 months.

If you’ve received advance child credit payments, in January 2022 the IRS will send you a letter recapping the amount of advance credit they sent you, this information will be needed when reconciling the advance credit payments with the actual credit on your 2021 return. Just in case the letter goes astray, you should carefully keep track of the advance credit payments you received.

The focus of this article is the advance child credit payments. But you may be interested to know that the American Rescue Plan Act that created the 2021 child tax credit rules did not repeal the prior law version of the child tax credit that capped the credit at $2,000 and allowed only part of it to be refundable. The phaseout described in this article applies to the increase in the credit. Families that aren't eligible for the higher child credit can claim the regular credit of $2,000 per child, less the amount of any monthly payments they received in advance, provided their AGI is below $400,000 on joint returns and $200,000 on other returns.

If you have questions related to how the advance payments may impact the outcome of your 2021 tax return and whether you should opt out of any additional advance payments, or perhaps adjust your withholding or estimated tax payments to account for the advance credits, please