If you use independent contractors to perform services for your business, for each one that you pay $600 or more for the year, you are needed to release the worker and the IRS a Form 1099-NEC no later than January 31, 2022, for 2021 payments.

Typically, a form 1099-NEC is not needed to be issued if the independent contractor or service provider is a corporation. Nevertheless, payments to attorneys for legal fees of $600 or more have to be reported, regardless of whether the attorney operates as a corporation.

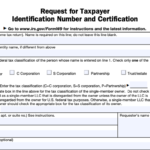

To properly complete the form, you'll need the individual's name and tax identification number. However it isn't uncommon to, say, hire a technician early in the year to whom you pay less than $600, and after that use the technician's services once again later on and have the total for the year surpass the $600 limit. If you neglected getting the details, like the person's complete name and tax identification number (TIN), required to file the 1099-NEC for the year, you might have trouble getting the information after-the-fact. For that reason, it is good practice to have individuals who are not incorporated complete and sign the IRS Form W-9 the first time you use their services. Having properly completed and signed Form W-9s for all independent contractors and service providers gets rid of any oversights and protects you against internal revenue service penalties and disputes.

IRS Form W-9 is given by the federal government as a method for you to get the information needed to file the 1099s for your contract workers and service providers. This information includes the individual's name, address, kind of service entity and TIN (generally a Social Security number or an Employer Identification Number), plus accreditations as to the ID number and citizenship status, to name a few.

It likewise provides you with confirmation that you complied with the law if the independent contractor give you with wrong info. We strongly advise that you have a potential independent contractor complete the Form W-9 before doing business with them. The form can either be printed out or filled onscreen on the IRS' site and afterwards printed out. A Spanish-language version is also available. The W-9 is for your use only and is not sent to the IRS. The W-9 was last modified by the IRS in October 2018, so if you have older blank W-9s that you offer to your service providers, you might prefer to print copies of the most recent version (including the instructions) and dispose of the older unused forms.

To prevent a penalty, the federal government's copies of the 1099-NECs should be transmitted to the IRS by January 31, 2022, together with transmittal Form 1096. They should be sent on magnetic media or on optically scannable forms. Nevertheless, a business that files more than 250 information returns (like 1099s, W-2s, and 1095s) in a calendar year is required to file them digitally. The 250-return requirement might be reduced to 100 if proposed policies are completed by the IRS, however the modification would not be effective till 2023.

Sometimes, for payments of $600 or more, you might require to file Form 1099-MISC, which is used to report rents, certain awards and prizes, and income your business paid besides that includible on Form 1099-NEC or payable to employees. The 2021 Form 1099-MISC need to be given to the income recipient by January 31, 2022, and to the IRS by February 28 (March 31 if filed electronically) accompanied by transmittal Form 1096.

My CPA PRO offers 1099 preparation services. If you require help or have concerns, please book a call with us.