Introduction:

Choosing the right accounting method isn’t just about compliance—it affects how you report income, claim deductions, and plan for taxes. The method you choose can impact everything from your tax liability to your ability to secure financing.

In this guide, we’ll cover the most common accounting methods used in the U.S., explain their pros and cons, and help you determine which is best for your business.

Watch this short video where we break down accounting methods for small business owners.

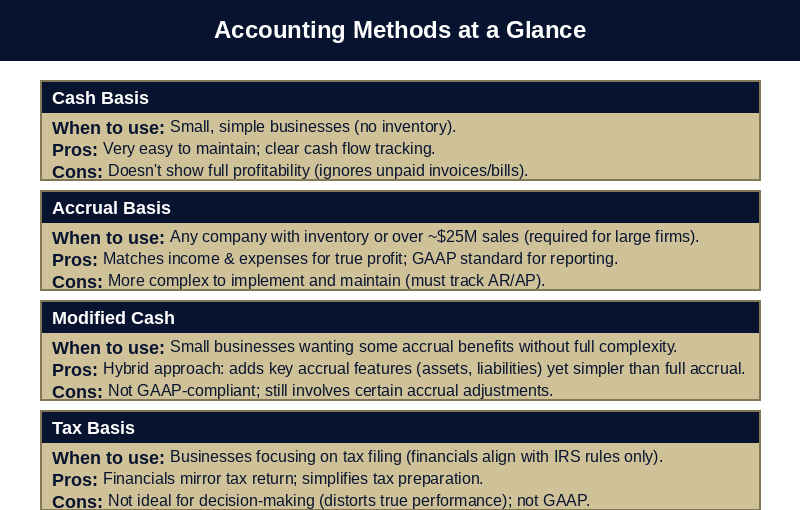

Accounting isn’t one-size-fits-all. Different methods serve different purposes. Here are the main types you need to know:

Income and expenses are recorded when money changes hands.

Income is recorded when earned, and expenses when incurred (not when cash moves).

IRS Rule: If you sell products or maintain inventory, the IRS generally requires accrual accounting for tax reporting.

Related Resource:

What Type of Accountant Do I Need for My Business?

This hybrid method combines elements of cash and accrual accounting—common for small businesses that want a more accurate view without full accrual complexity.

Designed for tax reporting, not management. Often similar to cash or accrual but includes IRS-specific adjustments, like depreciation and non-deductible expenses.

External Resource:

IRS Guide on Accounting Methods →

Pro Tip: Most small businesses need financial accounting for compliance—but managerial insights drive better business decisions.

Used in manufacturing and project-based businesses to track production costs, job costing, and profitability.

Consider these factors before deciding:

If you’re unsure, consult with a CPA. The right method can save thousands in taxes and make your financial life easier.

Related Resource:

How to Choose the Right Accountant for Your Business

GAAP focuses on external reporting accuracy; Tax Basis aligns with IRS rules for tax reporting.

Yes, but only in limited cases with proper compliance.

Cash basis is simplest—until your business grows or IRS rules require accrual.

Still unsure which method is right for you? Schedule a free strategy session below!

Choosing the right accounting method is a foundation for tax compliance and financial clarity. If you’re unsure which approach is right for your business, let us help.

✅ Schedule Your Free Tax & Accounting Strategy Session →

We’ll review your current setup, IRS requirements, and long-term goals—and make sure your accounting method supports your success.